The Upcoming Real Estate Opportunity

There is a lot of caution in the marketplace these days. Candidly, much of that caution is warranted. It’s easy to look at equities, and not know if/when the bottom will be and opt for fixed income opportunities. However, we believe strongly it's a mistake to cast that caution across all asset classes and investments. In this month’s newsletter we are going to dive into the stresses from the broader economy that effect real estate and why we see opportunity over the next 12-18 months where others may not. These include; high interest rates, a slowing economy, stimulus burn-off, an out of balance insurance market and increased vacancy.

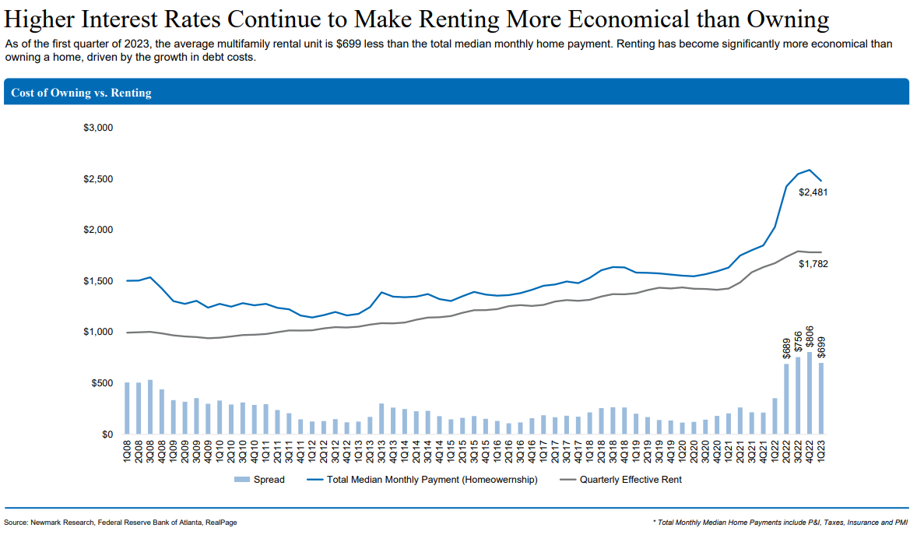

Everyone has felt the effects of higher interest rates. Whether you are looking to purchase a car, buy a new home, or simply look at the interest credit cards are charging, the cost to borrow has risen dramatically. The cost of money directly effects real estate investments. All else being equal, if the cost of money (interest rates) rise, investors can't afford to pay as much for a given property. In the last ~15 months, we have seen rates to borrow more than double resulting in value declines of anywhere from 10-20%++. Many owners that purchased towards the end of 21’ and beginning of 22’ are sitting on negative equity.

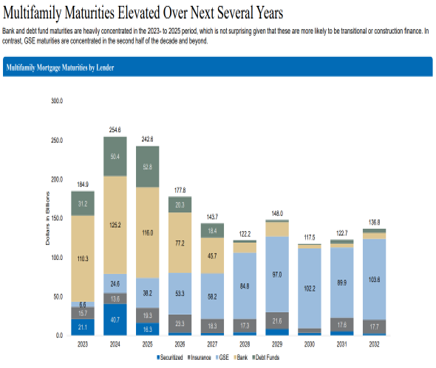

Many of those buyers financed purchases with floating rate loans which typically have terms of 2-5 years. For these borrowers, their options are few, refinance into fixed rate debt or sell. How big is this potential issue? In one Real Deal article the magazine highlighted just a few investment groups with billions of dollar in potential exposure.

This is where we see opportunity. Over the next 12-18 months some of these borrowers will be forced to sell into a market with higher costs and less liquidity - this would put upward pressure on cap rates and should mean lower prices for us.

Investors have also been sitting on the sidelines waiting for the recession that is coming but doesn't seem to arrive. The fear of a more than soft landing engineered by the FED has many larger investment groups taking a wait and see approach. This has caused the multifamily sales market to be less competitive than the last few years, increasing our ability to find a good deal. Some would ask DXE why are you not also sitting on the sidelines in anticipation of an upcoming recession? Our answer is simple, our timeline for an investment is usually 5-7 years and don't believe anyone can properly time the market. We are constantly offering on deals at our price letting the market come to us in the interest of buying fundamentally strong deals in up, down and sideways markets.

Insurance has become a major expense driver particularly for coastal multifamily properties. We have seen insurance rates increase 100-200% in one year in some markets. Florida has been hit particularly hard by rate increases. Why are the rates increasing so much so quickly? Losses, replacement cost and believe it or not, the FED. Multiple Hurricane and flooding events within the last 5 years have resulted in major payouts by insurance companies. Pair that with inflation and the cost of construction skyrocketing in these same regions due to overall demand. To make matters worse, insurance companies collect premiums and then invest those, a large portion of their investments were typically treasuries and real estate loans. Since the FED raised interest rates at a blistering pace, these companies couldn't divest and have been left with assets with significantly lower values (similar to regional banks). The conclusion - We don't think this is a lasting issue. Though we do not know when it will end; more investors and insurers will enter into these markets allowing competition to tighten pricing. We believe there is opportunity to purchase an asset at a market price and then allow insurance costs to normalize.

Occupancy and stimulus burn off may or may not be related but we have reason to believe they are. As the pandemic ended, the building boom in many cities commenced. Developers wanted to develop, interest rates were at record lows and banks needed to deploy equity. At the same time, the country was still awash with cash from stimulus spending, fueling a binge in apartment rentals nationwide. However, as the direct-to-consumer checks, rental assistance, eviction moratoriums and other stimulus started to wear off, those less fortunate were left with apartments they could not afford. This caused a surge of evictions (and eviction backlogs) in many municipalities that is still working its way out of the system. For those who purchased properties without accounting for normalized bad debt, rising expenses and evictions, this could mean pain and opening up a potential buying opportunity over the next 6-18 months.

We believe through our research and conservative underwriting standards DXE will be in a good position to identify real opportunities as they arise. Renters will need to continue renting with the leap to homeownership becoming more and more challenging.

You can't time the market but, recognizing compelling entry points and taking action has proven to be a successful investment strategy.